- Palantir Technologies and TWG Group have teamed up to revolutionise the financial sector with AI, integrating advanced cybersecurity and technology expertise to transform finance into an AI-powered ecosystem.

- Palantir’s CEO, Alex Karp, champions a unified AI product, offering comprehensive solutions across financial services, eliminating disparate vendor dependencies.

- TWG’s leadership, marked by Cukor’s military AI experience, emphasises safe, responsible AI deployment to boost efficiency across financial institutions’ operations.

- The partnership aims to overcome cybersecurity challenges by offering a cohesive solution, reducing reliance on fragmented third-party systems, and enhancing strategic productivity.

- The collaboration redefines AI as a dynamic labour force, merging data science with business insights, positioning AI as an integral part of finance’s future.

A groundbreaking partnership emerges as Palantir Technologies and TWG Group unite to propel the financial industry into a new era dominated by artificial intelligence. As these two formidable forces join hands, their endeavour is not just another tech collaboration—it’s a bid to redefine how financial institutions harness the power of AI.

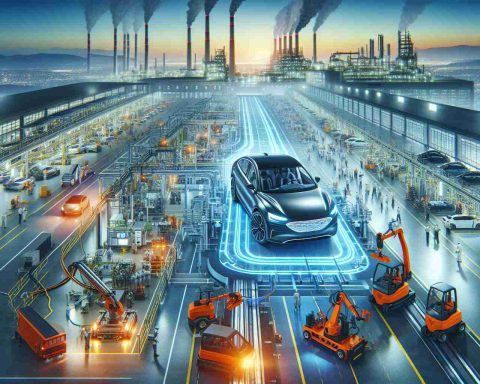

Imagine a world where the complexities of the financial sector are navigated with ease, and businesses stand poised not just to survive but to thrive amidst a chaotic global market. The joint venture’s commitment to leveraging Palantir’s cutting-edge cybersecurity and AI infrastructure, conjoined with TWG’s extensive business technology expertise, aims to transform this vision into a reality. Together, they dare to streamline AI integration on an unprecedented scale.

Marking a New Chapter in AI-Driven Finance

Palantir’s CEO, Alex Karp, is steering this ambitious initiative, aiming to revolutionise financial services through AI’s pervasive adoption. Karp envisions a landscape where companies no longer grapple with scattered solutions from multiple vendors. Instead, they are offered a comprehensive, integrated product deployed across banks, investment firms, and insurance companies—ushering them swiftly into the AI age.

On the TWG front, the charge is led by influential figures—Mark Walter, Thomas Tull, and Drew Cukor. Cukor’s experience with military and corporate AI initiatives exemplifies the venture’s ambition. His perspective is laser-focused on ensuring AI’s deployment is both safe and responsible, enhancing every sector from the front to the back office.

Addressing Cybersecurity Challenges

Cybersecurity remains a formidable hurdle for financial institutions cautiously approaching AI adoption. Drew Cukor, a veteran in military AI applications, highlights the enormous potential for AI to not just mimic human abilities but to augment them across thousands of use cases in finance. By treating AI as a strategic labour source rather than a mere technological tool, businesses can unlock unprecedented productivity gains.

The partnership also pledges to dismantle the cumbersome patchwork of third-party solutions that have historically burdened financial entities. Here, they present a unified solution, liberating institutions from the maze of contracts and reducing cybersecurity risks inherent in disparate systems.

Reimagining the Role of AI

Perhaps most striking is the paradigm shift in how AI is perceived. Cukor argues for a transformative view: AI is not a mere technological upgrade but a fusion of data science and business acumen. These digital entities are gradually surpassing human capabilities in performing tasks—observing, reasoning, and acting.

Palantir and TWG’s alliance invites the financial sector to embrace this evolutionary leap. Here lies a compelling narrative—a call to see AI not as a distant futuristic concept but as a dynamic, integral labour force ready to transform today’s complex business environments. The message is unmistakable: the future of finance is not only digital—it’s intelligent.

How AI is Revolutionising Finance: The Palantir and TWG Partnership

An Overview of the Palantir and TWG Collaboration

In a groundbreaking partnership, Palantir Technologies and TWG Group are leveraging their unique strengths to redefine the financial industry through artificial intelligence. This collaboration promises to streamline AI integration on a scale never seen before, providing integrated solutions for banks, investment firms, and insurance companies.

Evolution in AI-Driven Finance

Palantir’s CEO, Alex Karp, and TWG leaders Mark Walter, Thomas Tull, and Drew Cukor are spearheading this alliance. Their mission: to eliminate the fragmented solutions and multiple vendor dependencies currently burdening financial institutions. Instead, they aim to present a unified platform that melds cybersecurity, AI infrastructure, and business technology expertise, making AI adoption seamless and beneficial for every sector.

Cybersecurity and AI: A Unified Approach

A major concern for financial institutions is cybersecurity. The partnership between Palantir and TWG addresses these challenges head-on. They propose a solution that not only strengthens security but also enhances productivity by viewing AI as a strategic labour source. This unified approach reduces the risks inherent in using disparate third-party systems.

AI’s Transformative Role

The perception of AI in the financial sector is evolving. It is no longer seen as just a technological upgrade but as a core component of business operations, blending data science with business insights. This partnership is encouraging financial institutions to see AI as an active participant in their workforce that can surpass human capabilities in tasks like observing, reasoning, and decision-making.

Real-World Use Cases

1. Risk Management: AI systems can predict and mitigate risks by analysing vast datasets quickly and accurately, enabling enhanced decision-making processes.

2. Customer Service: Chatbots and intelligent agents can improve customer service efficiency, providing personalised assistance round-the-clock.

3. Fraud Detection: AI algorithms can detect unusual patterns and flag potential fraudulent activities, thereby protecting assets and reducing financial loss.

Addressing Limitations and Challenges

Despite these advancements, there are challenges in AI deployment, including ethical considerations, data privacy concerns, and the need for skilled personnel to manage AI systems. Continuous monitoring and improvements are essential to ensure safe and responsible use of AI technologies.

Future Insights and Predictions

As AI becomes more deeply embedded in the financial sector, we can expect broader adoption and innovation. Financial institutions that effectively integrate AI into their operations will likely witness increased efficiency, reduced costs, and enhanced customer satisfaction.

Actionable Recommendations

– Invest in AI Training: Organisations should train their workforce in AI technologies to fully leverage these tools.

– Adopt a Unified Platform: Opt for integrated AI solutions to minimise cybersecurity risks and enhance operational efficiency.

– Focus on Ethical AI Use: Prioritise ethical considerations and data privacy when implementing AI systems.

For more insights into AI’s role in finance, explore Palantir Technologies.

By embracing AI as a dynamic force in business operations, financial institutions can not only adapt to the changing technological landscape but also thrive in an increasingly competitive market. The message is clear: the future of finance is not only digital—it’s intelligent.