Perovskite Photovoltaic Device Engineering in 2025: The Breakthrough Era for Solar Innovation and Market Expansion. Explore How Next-Gen Materials and Rapid Commercialization Are Reshaping the Solar Industry.

- Executive Summary: Key Findings and 2025 Outlook

- Market Size, Growth, and Forecasts (2025–2030): CAGR, Revenue, and Installed Capacity

- Technology Landscape: Perovskite Materials, Device Architectures, and Efficiency Milestones

- Competitive Analysis: Leading Players, Startups, and Strategic Partnerships

- Manufacturing Innovations: Scalability, Cost Reduction, and Quality Control

- Application Segments: Utility-Scale, Rooftop, Flexible, and Tandem Solar Cells

- Regulatory Environment and Policy Drivers

- Challenges: Stability, Longevity, and Commercialization Barriers

- Investment Trends and Funding Landscape

- Future Outlook: Disruptive Potential and Scenario Analysis to 2030

- Sources & References

Executive Summary: Key Findings and 2025 Outlook

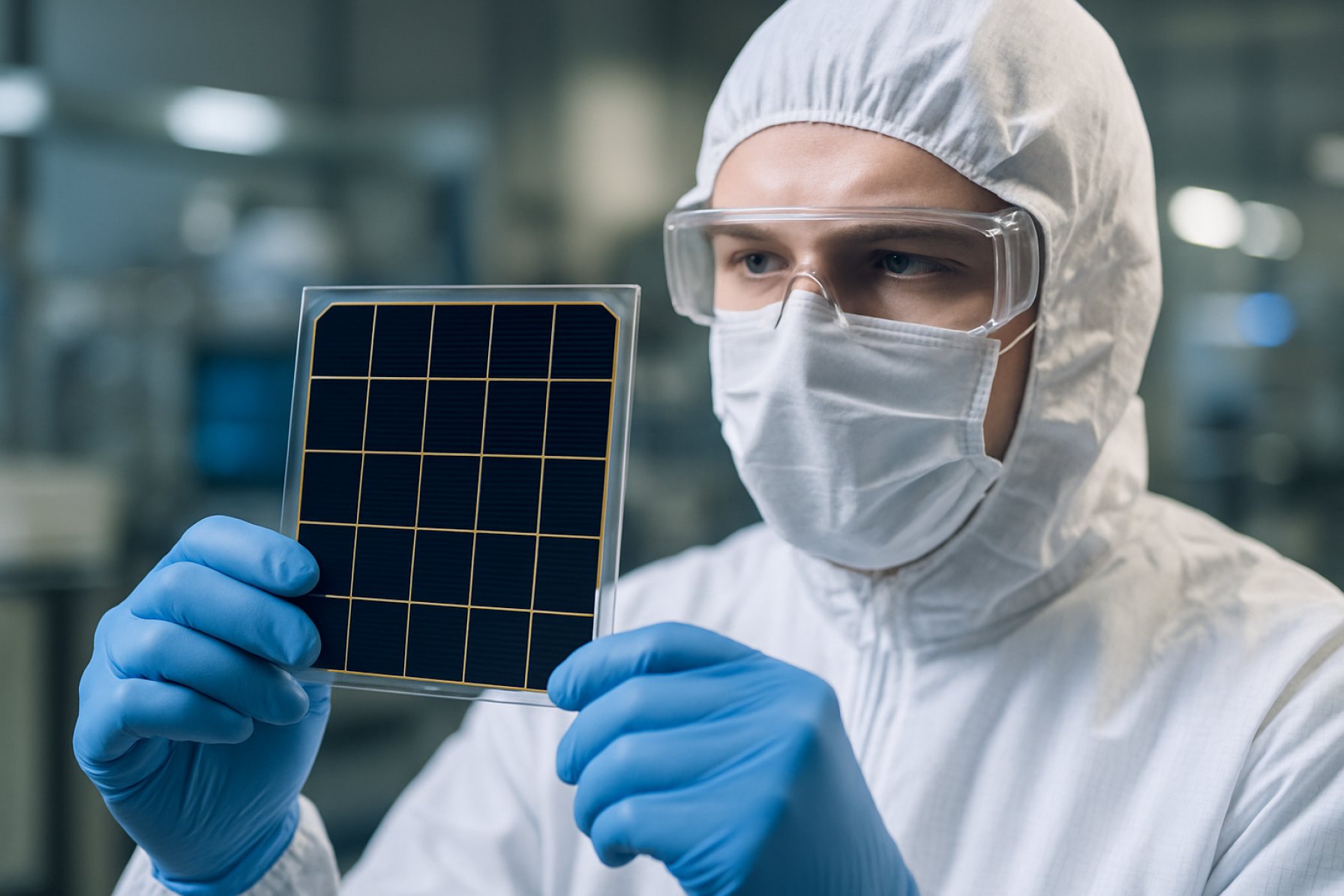

Perovskite photovoltaic device engineering has rapidly advanced, positioning perovskite solar cells (PSCs) as a leading next-generation photovoltaic technology. In 2024, research and pilot-scale manufacturing demonstrated record-breaking power conversion efficiencies (PCEs) exceeding 26%, rivaling traditional silicon-based cells. Key findings highlight significant improvements in device stability, scalability, and the development of tandem architectures that combine perovskites with silicon or other materials for enhanced performance.

A major breakthrough in 2024 was the successful scaling of perovskite modules to commercial sizes while maintaining high efficiency and operational stability. Companies such as Oxford PV and Saule Technologies have reported progress in roll-to-roll manufacturing and inkjet printing techniques, reducing production costs and enabling flexible, lightweight solar panels. Additionally, encapsulation methods and compositional engineering have extended device lifetimes, with some modules now projected to last over 20 years under real-world conditions.

The 2025 outlook anticipates the first wave of commercial perovskite-silicon tandem modules entering the market, with Oxford PV targeting mass production. Industry leaders are also focusing on lead-free perovskite formulations to address environmental and regulatory concerns, with Saule Technologies and academic consortia exploring tin-based alternatives. The European Union and China are increasing funding for perovskite research, aiming to secure supply chains and accelerate commercialization.

Challenges remain, particularly in ensuring long-term stability under diverse environmental conditions and scaling up production without compromising quality. However, the convergence of advanced materials engineering, improved manufacturing processes, and robust encapsulation solutions is expected to drive rapid adoption. By the end of 2025, perovskite photovoltaic devices are projected to capture a significant share of the emerging solar market, especially in building-integrated photovoltaics (BIPV) and portable applications.

In summary, perovskite photovoltaic device engineering is on the cusp of commercial viability, with 2025 set to be a pivotal year for market entry, technological maturation, and the establishment of new industry standards.

Market Size, Growth, and Forecasts (2025–2030): CAGR, Revenue, and Installed Capacity

The global market for perovskite photovoltaic (PV) device engineering is poised for significant expansion between 2025 and 2030, driven by rapid advancements in material science, manufacturing scalability, and increasing demand for high-efficiency solar technologies. According to industry projections, the perovskite PV sector is expected to achieve a compound annual growth rate (CAGR) exceeding 30% during this period, outpacing traditional silicon-based photovoltaics in both innovation and market penetration.

Revenue from perovskite PV devices is forecasted to surpass $2 billion by 2030, as commercial-scale production ramps up and new applications—such as building-integrated photovoltaics (BIPV), flexible solar panels, and tandem solar cells—gain traction. This growth is underpinned by the technology’s potential for low-cost manufacturing, lightweight form factors, and superior power conversion efficiencies, which have already reached over 25% in laboratory settings, as reported by National Renewable Energy Laboratory and Helmholtz-Zentrum Berlin.

Installed capacity of perovskite-based solar modules is projected to grow from pilot-scale deployments in 2025 to several gigawatts (GW) by 2030. Early commercial installations are expected in regions with strong policy support and established solar infrastructure, such as the European Union, China, and select markets in North America. Companies like Oxford PV and Saule Technologies are leading the transition from laboratory prototypes to mass production, with plans to scale up manufacturing lines and expand their global footprint.

The market’s trajectory will be shaped by ongoing improvements in device stability, environmental durability, and the development of lead-free perovskite formulations. Industry collaborations and public-private partnerships, such as those coordinated by International Energy Agency Photovoltaic Power Systems Programme (IEA PVPS), are expected to accelerate commercialization and standardization efforts. As a result, perovskite PV device engineering is set to become a cornerstone of the next-generation solar industry, with robust growth prospects through 2030 and beyond.

Technology Landscape: Perovskite Materials, Device Architectures, and Efficiency Milestones

The technology landscape of perovskite photovoltaic (PV) device engineering in 2025 is marked by rapid advancements in material science, device architectures, and record-setting efficiency milestones. Perovskite materials, defined by their ABX3 crystal structure, have emerged as a leading class of semiconductors for next-generation solar cells due to their tunable bandgaps, high absorption coefficients, and solution-processability. The most widely studied perovskites are hybrid organic-inorganic lead halide compounds, such as methylammonium lead iodide (MAPbI3), which have demonstrated remarkable optoelectronic properties.

Device architectures have evolved significantly, with two primary configurations dominating research and commercial interest: the mesoporous structure and the planar heterojunction. The mesoporous architecture, initially adapted from dye-sensitized solar cells, incorporates a scaffold (typically TiO2) to enhance charge separation and transport. In contrast, planar architectures, which can be either n-i-p or p-i-n, offer simpler fabrication and are more compatible with large-area manufacturing. Innovations in interface engineering, such as the introduction of self-assembled monolayers and passivation layers, have further reduced non-radiative recombination losses and improved device stability.

Efficiency milestones have been a hallmark of perovskite PV progress. In 2023, certified single-junction perovskite solar cells surpassed 26% power conversion efficiency, rivaling traditional silicon cells. Tandem devices, which stack perovskite layers atop silicon or other perovskites, have achieved even higher efficiencies—over 33% in laboratory settings—by capturing a broader spectrum of sunlight. These records are tracked and verified by organizations such as the National Renewable Energy Laboratory and the Fraunhofer Institute for Solar Energy Systems ISE.

Material innovation remains a central focus, with efforts to replace toxic lead with tin or other metals, and to enhance intrinsic stability against moisture, heat, and UV exposure. Companies like Oxford PV and Solaronix are at the forefront of scaling up perovskite-silicon tandem modules for commercial deployment. As the field moves toward 2025, the convergence of advanced materials, optimized device architectures, and scalable manufacturing processes is expected to accelerate the commercialization of perovskite PV technologies, potentially reshaping the global solar energy market.

Competitive Analysis: Leading Players, Startups, and Strategic Partnerships

The competitive landscape of perovskite photovoltaic device engineering in 2025 is marked by a dynamic interplay between established industry leaders, innovative startups, and a growing web of strategic partnerships. Major players such as Oxford Photovoltaics Ltd and Saule Technologies continue to drive advancements in perovskite solar cell efficiency and scalability. Oxford Photovoltaics Ltd has made significant strides in commercializing perovskite-on-silicon tandem cells, achieving record-breaking efficiencies and moving towards mass production. Meanwhile, Saule Technologies focuses on flexible, lightweight perovskite modules, targeting applications in building-integrated photovoltaics (BIPV) and the Internet of Things (IoT).

Startups are playing a crucial role in pushing the boundaries of perovskite device engineering. Companies like Solaronix SA and GCL System Integration Technology Co., Ltd. are exploring novel materials, scalable manufacturing techniques, and new device architectures. These firms often collaborate with academic institutions and research organizations to accelerate innovation and address challenges such as long-term stability and lead toxicity.

Strategic partnerships are increasingly shaping the sector’s trajectory. For example, Oxford Photovoltaics Ltd has partnered with Meyer Burger Technology AG to integrate perovskite technology into existing silicon solar cell manufacturing lines, aiming to leverage established infrastructure for rapid market entry. Similarly, Saule Technologies collaborates with construction and electronics companies to develop customized perovskite solutions for smart buildings and consumer devices.

Industry consortia and public-private initiatives, such as those led by the National Renewable Energy Laboratory (NREL) and the Helmholtz-Zentrum Berlin, foster pre-competitive research and standardization efforts. These collaborations are vital for addressing technical barriers, establishing reliability benchmarks, and facilitating the transition from laboratory-scale prototypes to commercial products.

In summary, the competitive environment in perovskite photovoltaic device engineering is characterized by a blend of established companies, agile startups, and strategic alliances, all working to overcome technical hurdles and unlock the commercial potential of this transformative solar technology.

Manufacturing Innovations: Scalability, Cost Reduction, and Quality Control

Recent years have witnessed significant advancements in the manufacturing of perovskite photovoltaic (PV) devices, with a focus on scalability, cost reduction, and quality control. The transition from laboratory-scale fabrication to industrial-scale production is a critical step for the commercialization of perovskite solar cells. One of the most promising approaches for scalable manufacturing is roll-to-roll (R2R) processing, which enables continuous deposition of perovskite layers on flexible substrates. Companies such as Oxford PV and Saule Technologies are pioneering R2R and other scalable coating techniques, including slot-die coating and blade coating, to produce large-area modules efficiently.

Cost reduction is another key driver in perovskite PV engineering. The use of abundant and low-cost raw materials, combined with low-temperature solution processing, allows perovskite devices to be manufactured at a fraction of the cost of traditional silicon-based solar cells. Innovations in ink formulation and solvent engineering have further reduced material waste and improved deposition uniformity, contributing to lower production costs. Additionally, the integration of perovskite layers with existing silicon PV lines (tandem architectures) leverages established manufacturing infrastructure, as demonstrated by Meyer Burger Technology AG and Hanwha Solutions.

Quality control remains a central challenge as perovskite PV moves toward mass production. Ensuring uniformity, defect minimization, and long-term stability requires advanced in-line monitoring and characterization tools. Techniques such as real-time photoluminescence imaging and machine learning-based defect detection are being implemented to identify and mitigate issues during fabrication. Organizations like National Renewable Energy Laboratory (NREL) are actively developing protocols for accelerated aging tests and reliability assessments to ensure that perovskite modules meet international standards.

In summary, the convergence of scalable manufacturing techniques, cost-effective materials and processes, and robust quality control systems is accelerating the path toward commercial perovskite PV deployment. Continued collaboration between industry leaders and research institutions is expected to further enhance the manufacturability and reliability of perovskite solar technologies in 2025 and beyond.

Application Segments: Utility-Scale, Rooftop, Flexible, and Tandem Solar Cells

Perovskite photovoltaic device engineering has rapidly diversified, enabling tailored solutions across multiple application segments. The four primary segments—utility-scale, rooftop, flexible, and tandem solar cells—each leverage the unique properties of perovskite materials to address specific market needs and technical challenges.

Utility-scale perovskite solar cells are being developed to compete with traditional silicon-based modules in large solar farms. Their high power conversion efficiencies and potential for low-cost, scalable manufacturing make them attractive for grid-level deployment. However, engineering efforts focus on improving long-term stability and scaling up fabrication processes to meet the rigorous demands of utility installations. Companies such as Oxford PV are pioneering perovskite-silicon tandem modules for this segment, aiming to surpass the efficiency limits of conventional photovoltaics.

Rooftop applications benefit from perovskite’s lightweight and tunable aesthetic properties. The ability to deposit perovskite layers on a variety of substrates allows for integration into building-integrated photovoltaics (BIPV), including semi-transparent panels for windows and facades. Engineering challenges here include ensuring durability against environmental stressors and optimizing module design for partial shading and variable installation angles. Solaronix and other innovators are exploring these avenues to bring perovskite technology to residential and commercial rooftops.

Flexible perovskite solar cells exploit the material’s compatibility with plastic and metal foils, enabling lightweight, bendable modules. This segment targets portable electronics, wearables, and off-grid applications where traditional rigid panels are impractical. Device engineering focuses on developing robust encapsulation methods and flexible electrodes to maintain performance under mechanical stress. Heliatek GmbH is among the companies advancing flexible organic and perovskite photovoltaics for these emerging markets.

Tandem solar cells combine perovskite layers with established photovoltaic materials, such as silicon or CIGS, to achieve higher efficiencies by capturing a broader spectrum of sunlight. Engineering tandem architectures requires precise control over layer interfaces and bandgap alignment. The collaborative efforts of National Renewable Energy Laboratory (NREL) and industry partners are pushing tandem perovskite-silicon cells toward commercial viability, with record efficiencies already demonstrated in laboratory settings.

Each application segment presents distinct engineering challenges and opportunities, driving innovation in materials, device architecture, and manufacturing processes within the perovskite photovoltaic sector.

Regulatory Environment and Policy Drivers

The regulatory environment and policy landscape for perovskite photovoltaic (PV) device engineering in 2025 is shaped by a global push toward decarbonization, energy security, and technological innovation. Governments and international organizations are increasingly recognizing the potential of perovskite solar cells to accelerate the transition to renewable energy due to their high efficiency, low manufacturing costs, and compatibility with flexible substrates. As a result, policy frameworks are evolving to support research, commercialization, and deployment of perovskite PV technologies.

In the European Union, the European Commission has integrated perovskite PVs into its broader strategies for clean energy innovation, such as the European Green Deal and the Horizon Europe research program. These initiatives provide funding for pilot projects, support for scale-up, and regulatory guidance on safety and environmental standards. The EU is also working on harmonizing certification and testing protocols for emerging PV technologies, including perovskites, to facilitate market entry and cross-border trade.

In the United States, the U.S. Department of Energy (DOE) has prioritized perovskite research through its Solar Energy Technologies Office, launching initiatives like the Perovskite Startup Prize and funding collaborative research centers. The DOE is also developing guidelines for accelerated lifetime testing and environmental impact assessments, which are critical for the bankability and insurability of perovskite PV products.

China, a major player in the global solar industry, is actively supporting perovskite PV development through national programs led by the Ministry of Science and Technology of the People’s Republic of China. These programs focus on scaling up manufacturing, improving device stability, and establishing standards for quality control. Chinese regulatory agencies are also working to align domestic standards with international best practices to enhance export opportunities.

Globally, organizations such as the International Energy Agency (IEA) and the International Electrotechnical Commission (IEC) are facilitating the development of technical standards and roadmaps for perovskite PVs. These efforts aim to address challenges related to long-term stability, toxicity (notably lead content), and end-of-life management, ensuring that perovskite technologies can be safely and sustainably integrated into the energy mix.

Overall, the regulatory and policy environment in 2025 is increasingly supportive of perovskite PV device engineering, with a focus on fostering innovation, ensuring safety, and accelerating commercialization while addressing environmental and societal concerns.

Challenges: Stability, Longevity, and Commercialization Barriers

Perovskite photovoltaic devices have rapidly advanced in efficiency, but their widespread adoption faces significant challenges related to stability, longevity, and commercialization. One of the primary hurdles is the intrinsic instability of perovskite materials when exposed to environmental factors such as moisture, oxygen, heat, and ultraviolet light. These stressors can lead to rapid degradation of the perovskite layer, resulting in a marked decline in device performance over time. Efforts to improve stability have included the development of encapsulation techniques and the engineering of more robust perovskite compositions, yet achieving operational lifetimes comparable to established silicon photovoltaics remains elusive.

Another critical issue is the chemical and mechanical compatibility of perovskite layers with other device components. Interfacial reactions between the perovskite and charge transport layers can induce ion migration, phase segregation, or the formation of non-radiative recombination centers, all of which undermine device efficiency and durability. Researchers are exploring new materials for charge transport layers and interface engineering strategies to mitigate these effects, but scalable, cost-effective solutions are still under development.

From a commercialization perspective, the use of lead in most high-efficiency perovskite formulations raises environmental and regulatory concerns. While alternative lead-free perovskites are being investigated, they generally lag behind in performance and stability. Additionally, the reproducibility and scalability of perovskite device fabrication present significant manufacturing challenges. Achieving uniform, defect-free films over large areas is difficult, and process variations can lead to inconsistent device quality. Industry leaders such as Oxford PV and Solaronix SA are actively working on pilot-scale production and upscaling, but the transition to mass production requires further innovation in materials processing and quality control.

Finally, the lack of standardized testing protocols for perovskite solar cells complicates the assessment of long-term performance and reliability. Organizations like the National Renewable Energy Laboratory are collaborating with industry and academia to develop consensus standards, but widespread adoption is still in progress. Overcoming these barriers is essential for perovskite photovoltaics to realize their potential as a transformative solar technology.

Investment Trends and Funding Landscape

The investment landscape for perovskite photovoltaic (PV) device engineering in 2025 is characterized by a surge in both public and private funding, reflecting the technology’s rapid progress toward commercialization. Venture capital and corporate investments have notably increased, driven by the promise of perovskite solar cells to deliver higher efficiencies and lower manufacturing costs compared to traditional silicon-based photovoltaics. Major energy companies and technology conglomerates, such as Compagnie de Saint-Gobain and Toshiba Corporation, have expanded their portfolios to include perovskite PV startups and joint ventures, aiming to secure early access to next-generation solar technologies.

Governmental support remains a cornerstone of the funding ecosystem. The European Union, through initiatives like HORIZON Europe, and the U.S. Department of Energy’s Solar Energy Technologies Office have allocated substantial grants to accelerate research, scale-up, and pilot manufacturing of perovskite modules. These programs often emphasize collaborative projects between universities, research institutes, and industry, fostering innovation and de-risking early-stage development.

A notable trend in 2025 is the emergence of dedicated perovskite PV investment funds and accelerators, such as those supported by EIT RawMaterials and EIT InnoEnergy. These entities provide seed capital, technical mentorship, and market access, helping startups bridge the gap between laboratory breakthroughs and commercial-scale production. Additionally, established solar manufacturers like Hanwha Group and JinkoSolar Holding Co., Ltd. are investing in perovskite-silicon tandem technologies, signaling confidence in hybrid device architectures.

Despite the optimistic funding climate, investors remain attentive to challenges such as long-term stability, scalability, and regulatory approval. Due diligence processes increasingly focus on intellectual property portfolios, pilot line performance, and lifecycle assessments. As perovskite PV engineering matures, the funding landscape is expected to further diversify, with increased participation from institutional investors and strategic corporate partners seeking to capitalize on the technology’s disruptive potential.

Future Outlook: Disruptive Potential and Scenario Analysis to 2030

The future outlook for perovskite photovoltaic (PV) device engineering is marked by both significant disruptive potential and a range of plausible scenarios leading up to 2030. Perovskite solar cells have rapidly advanced in efficiency, scalability, and stability, positioning them as a transformative technology in the global energy landscape. Their unique properties—such as tunable bandgaps, solution processability, and compatibility with flexible substrates—enable applications beyond traditional silicon photovoltaics, including building-integrated photovoltaics (BIPV), lightweight portable power, and tandem solar modules.

By 2030, several scenarios could unfold. In the most optimistic case, perovskite PVs achieve commercial-scale production with lifetimes and reliability matching or surpassing established silicon modules. This would be driven by breakthroughs in encapsulation, defect passivation, and environmentally benign lead management, as well as the development of robust manufacturing supply chains. Such advances could enable perovskite-silicon tandem modules to reach efficiencies above 30%, significantly lowering the levelized cost of electricity (LCOE) and accelerating global solar adoption. Leading research institutions and industry consortia, such as National Renewable Energy Laboratory and imec, are actively pursuing these goals.

A more moderate scenario envisions perovskite PVs carving out niche markets—such as semi-transparent modules for windows or lightweight panels for transportation—while ongoing reliability and toxicity concerns limit their widespread deployment. In this case, perovskite technology complements rather than replaces silicon, with hybrid modules and specialty applications driving incremental market growth. Industry players like Oxford PV and Saule Technologies are already piloting such products.

Conversely, a pessimistic scenario could see regulatory hurdles, persistent stability issues, or supply chain bottlenecks delaying or constraining commercialization. Environmental concerns, particularly regarding lead content, may prompt stricter regulations or public resistance, slowing adoption unless effective recycling and mitigation strategies are implemented. Organizations such as the International Energy Agency are monitoring these developments and advising on best practices.

Overall, the disruptive potential of perovskite PV device engineering remains high, with the next five years being critical for resolving technical and regulatory challenges. The trajectory to 2030 will depend on coordinated efforts across research, industry, and policy to unlock the full promise of this next-generation solar technology.

Sources & References

- Oxford PV

- Saule Technologies

- National Renewable Energy Laboratory

- Helmholtz-Zentrum Berlin

- Fraunhofer Institute for Solar Energy Systems ISE

- Solaronix

- Meyer Burger Technology AG

- Heliatek GmbH

- European Commission

- Ministry of Science and Technology of the People’s Republic of China

- International Energy Agency

- Toshiba Corporation

- HORIZON Europe

- EIT RawMaterials

- EIT InnoEnergy

- JinkoSolar Holding Co., Ltd.

- imec